Welcome To Cohen Financial Group “HEAR US ON”

A Few Words About Us

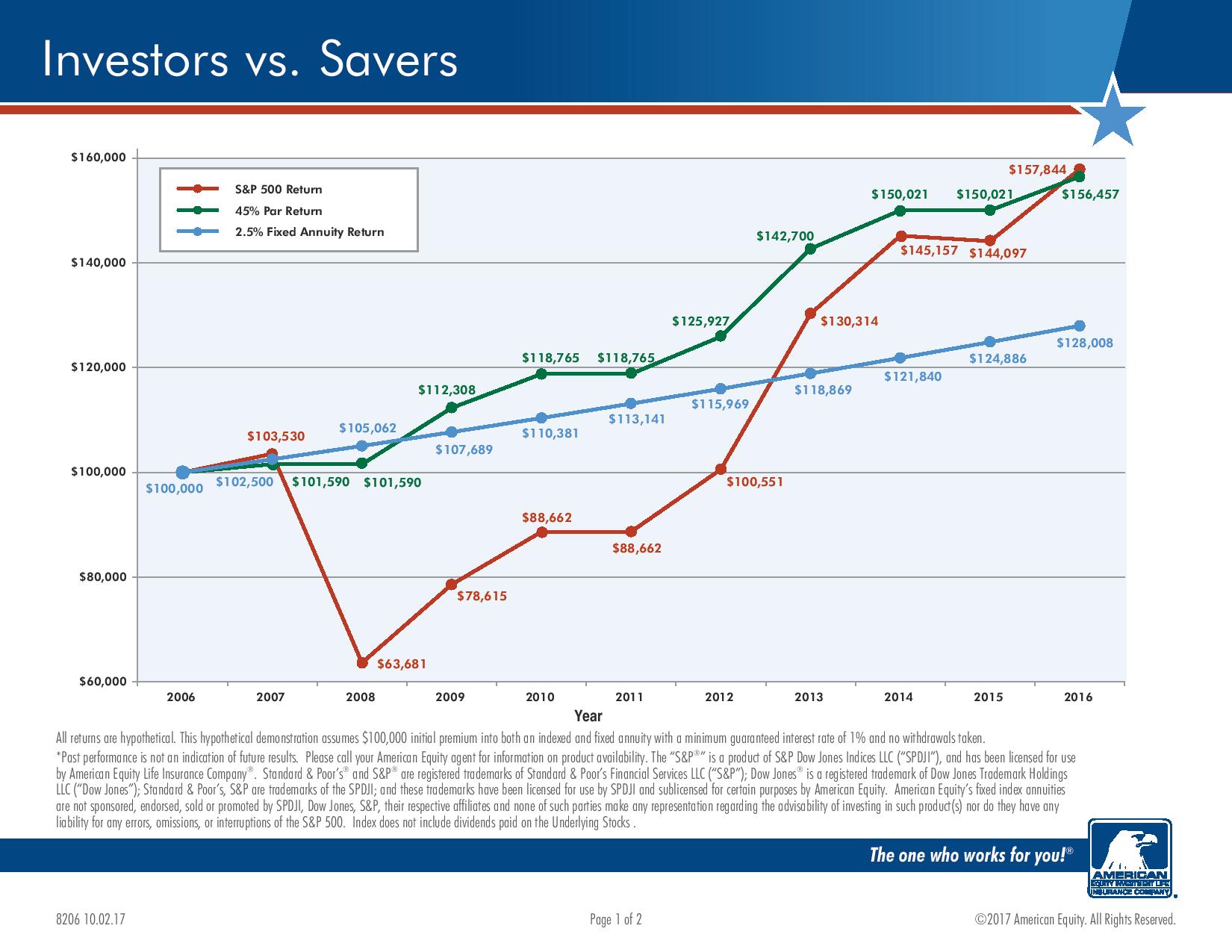

We here at Cohen Financial Group specialize in looking at the WHOLE PICTURE for our clients by re-allocating and re-positioning retirement assets for safety, growth, legacy planning, and income planning. We gather complete information to help our clients make informed decisions in an easy to understand manner to assist with their particular situation.

Financial Services

Our primary goal is keeping our clients’ money safe from volatile and risky investments.

Learn MoreInsurance Services

Developing the right portfolio of insurance products is an essential step toward a comprehensive financial program or estate planning.

Learn MoreWorkshop Schedule

Learn MoreEducational Videos

Check our very informative educational video page. Here you can watch and learn some valuable information about financial and insurance services

Learn MoreWeekly Newsletter

7 Spring Cleaning Moves for Your Finances

Here's how to get your financial house in order Forget cleaning out the closet, scrubbing the floors and washing the windows. The start of spring is an even better time to get your finances in order. “One thing on many people’s minds is cleaning. But what if you put...

What’s Changing for Retirement in 2024?

Inflation adjustments and the phase-in of Secure 2.0 provisions have implications for retirement savers and retirees alike. The dawning of 2024 will usher in more changes than usual on the retirement-planning front. As is typical with the turn of the calendar page,...

How to Deal With a Big Tax Bill

Don’t panic — but do pay the tax tab Bills are a fact of life, though some require more urgent attention than others. Ignore your brother-in-law because you still owe him $50 from last year’s poker game, and you’ll get the cold shoulder. Ignore your debt to Uncle Sam,...

IRA Blog

ED SLOTT’S ELITE ADVISOR GROUP℠ MEETS IN INDIANA

By Andy Ives, CFP®, AIF® IRA Analyst Follow Us on X: @theslottreport Ed Slott’s Elite IRA Advisor Group℠ gathered in Indianapolis last week for another successful conference. Over 350 member advisors from across the country spent two intense days of training,...

QUALIFIED CHARITABLE DISTRIBUTIONS (QCDS) AND SOLO 401(K) PLANS: TODAY’S SLOTT REPORT MAILBAG

By Ian Berger, JD IRA Analyst Follow Us on X: @theslottreport Question: Can a QCD (qualified charitable distribution) be made from a 401(k) plan? Thanks! Answer: No, QCDs can only be made from IRAs and inactive SEP or SIMPLE IRAs. One possible workaround would...

A CHEAT SHEET FOR IRA BENEFICIARY RMDS

By Ian Berger, JD IRA Analyst Follow Us on X: @theslottreport It’s been over four years since the SECURE Act upended the rules for beneficiary IRA required minimum distributions (RMDs), and there’s still plenty of confusion about the new rules. The IRS did give...